Inherited Roth Ira Distribution Rules 2024 - Explore more about inherited ira distribution rules. What are the New Rules for Inherited IRAs? Inflation Protection, Irs updates timeline for ruling on inherited ira distributions. Gay cfp writing about having a wealthier healthier and happier life.

Explore more about inherited ira distribution rules.

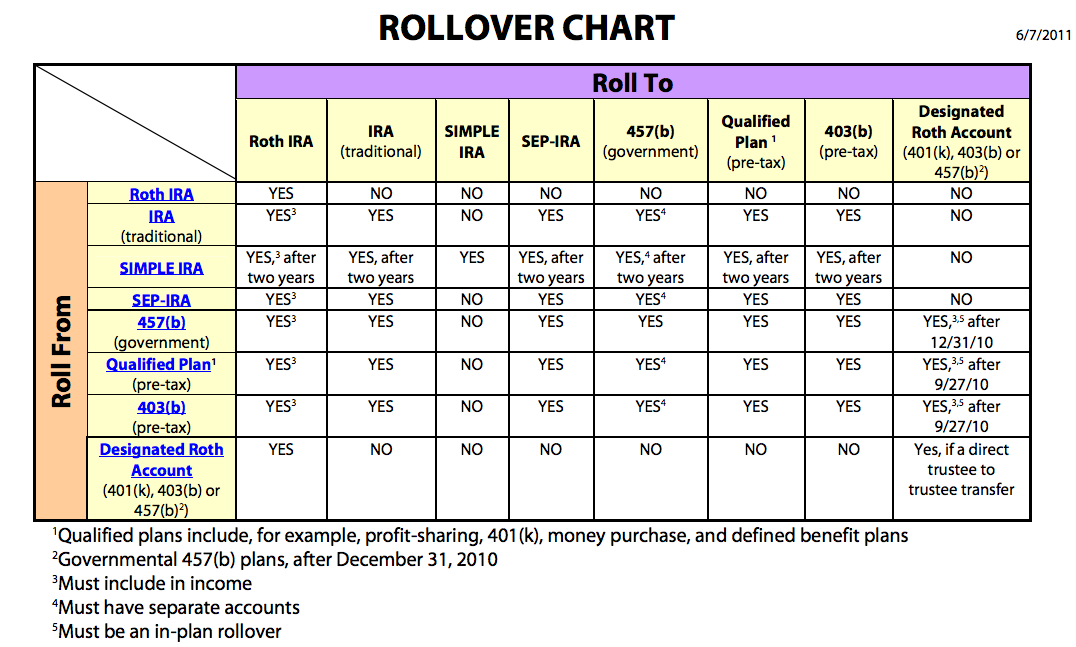

This can be a way to take some of the inherited ira distributions and use them to fund a roth ira for the next generation.

Rules for Inherited Roth IRAs Fee Only, Fiduciary, Financial Planning, Keep in mind, though, that any voluntary or required minimum distribution (rmd) from the account is taxable,. Required minimum distributions begin at 73, but you can choose to delay your first distribution.

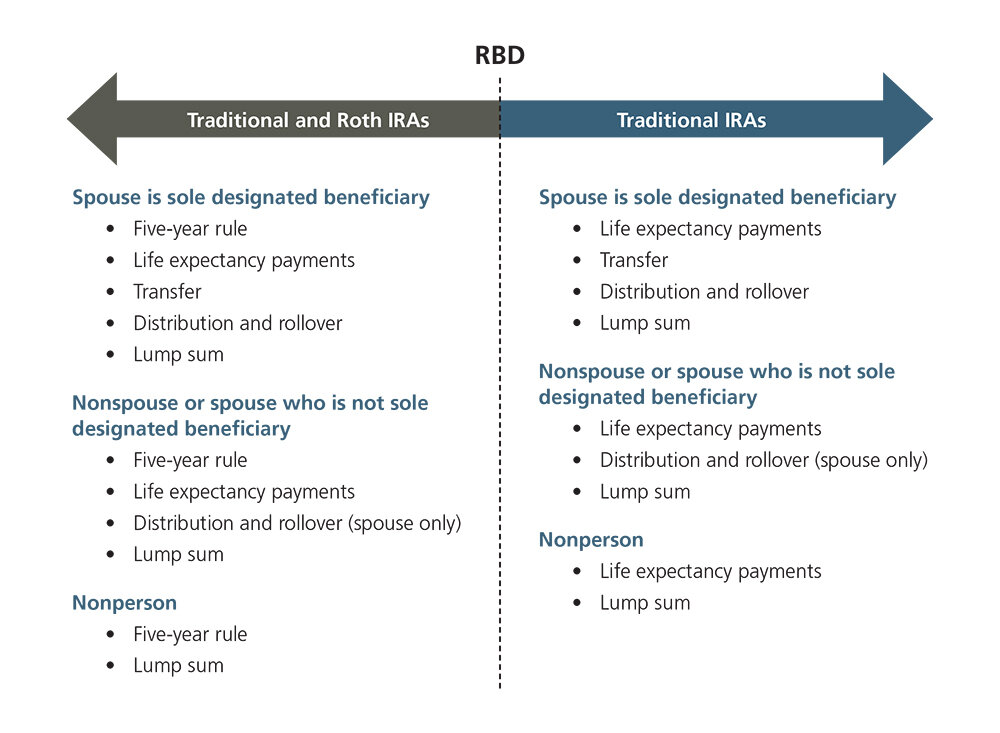

what are the rules for a spousal ira Choosing Your Gold IRA, Distributions from an inherited ira may be required. The rmd rules are different for each choice and.

Inherited Roth Ira Distribution Rules 2024. Rollover the account into their own ira. Gay cfp writing about having a wealthier healthier and happier life.

Successor Beneficiary RMD Rules After The Death Of The Original, Spouse as sole designated beneficiary. The rmd rules are different for each choice and.

+1000px.jpg)

What Is An Inherited Ira Distribution Rules And Examples Thestreet ZOHAL, If you have inherited an ira or have any other retirement plan account, it's important to be aware of the secure 2.0 act. In this case, they won’t be subject to rmds.

If you open a custodial roth ira and contribute the $7,000 maximum to.

Understanding which class or designation applies to you will help you.

Ready to Retire Really! Rules of the Roth, Story by retirement daily guest contributor. In this case, they won’t be subject to rmds.

Story by retirement daily guest contributor. Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended.

What can I do with an Inherited Roth IRA? Inflation Protection, Your relationship to the original account owner: Last updated 17 april 2024.

Inherited Ira Minimum Distribution Table Elcho Table, Here are three new rules retirees need to know about in 2024. The irs recently announced that in 2024, for the fourth consecutive year, ira beneficiaries don’t have to take the annual required minimum distributions (rmds).

Beneficiary Ira Rmd Table 2017 Matttroy, Required minimum distributions begin at 73, but you can choose to delay your first distribution. If you open a custodial roth ira and contribute the $7,000 maximum to.

NonSpouse Beneficiaries Rules For An Inherited 401k Inherited ira, Spouse as sole designated beneficiary. Don't get blindsided by taxes: